· it maintenance · 2 min read

Essential IT Maintenance for Accounting Offices During Tax Season

Learn how proper IT maintenance can keep your accounting firm running smoothly during the busy tax season, avoiding downtime and enhancing performance.

Essential IT Maintenance for Accounting Offices During Tax Season

Tax season is the accounting world’s Super Bowl, and like any great team, your office needs to be in peak condition to tackle the rush. Ensuring your IT systems are up to snuff can mean the difference between smooth sailing and a disastrous fumble. Proper IT maintenance is your game plan to stay ahead of the competition, avoid downtime, and keep everything running smoothly.

1. Preparing Your Systems for Peak Performance

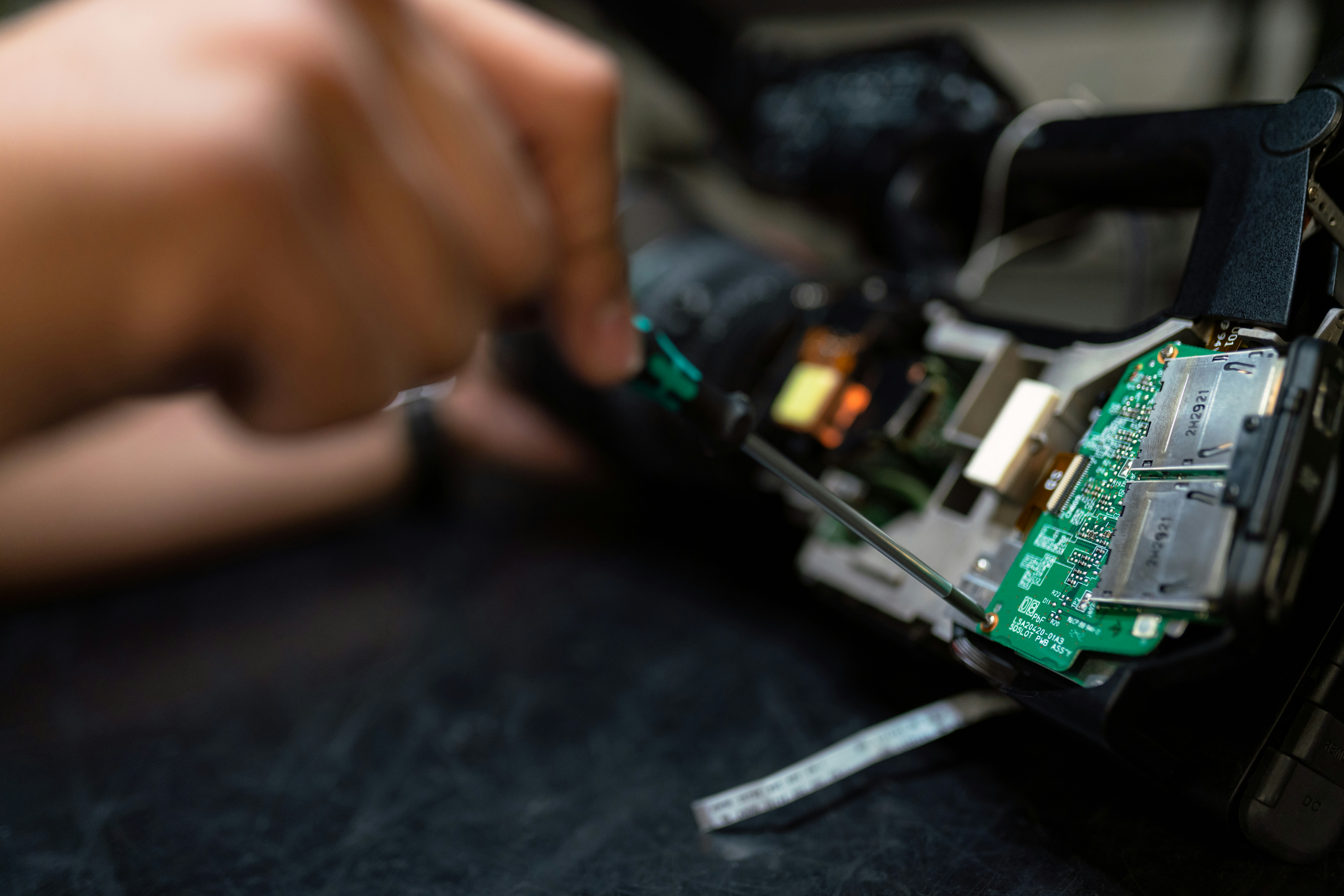

Routine hardware checks:

- Ensure all devices are functioning properly: Regularly inspect computers, printers, and network devices for any issues.

- Upgrade outdated hardware: Replace old equipment that may not handle increased workload efficiently.

Software updates and patches:

- Keep everything current: Ensure all software, including operating systems and applications, are up-to-date.

- Automate updates: Use tools to schedule and manage updates to minimize disruptions.

Network reliability:

- Optimize internet and internal network performance: Conduct speed tests and optimize settings for peak performance.

- Backup internet connections: Have a secondary connection to switch to in case of primary network failure.

2. Data Management and Backup Procedures

Scheduled backups:

- Frequent, automatic backups: Set up automatic backups to occur during off-peak hours to avoid interruptions.

- Verify backup integrity: Regularly test backups to ensure they are complete and can be restored if needed.

Data cleanup and organization:

- Streamline your data: Remove outdated files and organize current data for quick access.

- Use data management tools: Employ software solutions to help organize and maintain data efficiently.

Cloud storage utilization:

- Leverage cloud solutions: Use cloud storage for additional security and accessibility.

- Hybrid storage solutions: Combine local and cloud storage for a robust backup strategy.

3. Security Measures During High-Stress Periods

Enhanced cybersecurity protocols:

- Extra vigilance against phishing and malware attacks: Increase monitoring and educate staff on recognizing threats.

- Firewall and antivirus updates: Ensure all security software is current and properly configured.

User access controls:

- Ensure only authorized personnel can access sensitive data: Implement role-based access controls.

- Review access logs: Regularly monitor access logs for any unusual activity.

Employee training:

- Refresher courses on security best practices: Conduct regular training sessions to keep security knowledge fresh.

- Simulated phishing exercises: Test staff awareness with controlled phishing simulations.

Call to Action & Conclusion:

Keep your IT systems in top shape to ensure a smooth tax season. Regular maintenance, robust security, and efficient data management will help you handle the rush with ease. Don’t wait until it’s too late—start your IT prep now and face tax season like a pro.